Edge data centers are not a new concept in India’s tech ecosystem. They have long been embedded in telco infrastructure, financial networks, and enterprise backbones. But with rising demand for faster, more localized digital services, these once-overlooked assets are taking center stage.

Edge facilities are modular, scalable, and resilient deployed in locations such as manufacturing floors, telco exchanges, traffic intersections, hospitals, and retail outlets. Their proximity to end-users ensures faster performance, minimal latency, and better compliance with local data regulations.

-

- Device Edge: Computation on end-devices like smartphones, sensors, cameras.

-

- Embedded/Micro Edge: Processing units embedded in machines (e.g., kiosks, robots).

-

- On-Prem Edge: Local servers at enterprise premises.

-

- Metro Edge: Edge nodes deployed in urban data centers for broader area coverage.

- Near vs. Far Edge: Near Edge is closer to core aggregation points; Far Edge resides right at the data source.

-

- Digital Growth Beyond Metros Tier-2 and Tier-3 cities are witnessing a surge in digital consumption e-commerce, e-governance, OTT necessitating local data processing infrastructure.

-

- 5G and Real-Time Applications Next-gen use cases like autonomous vehicles, AR/VR, and telemedicine demand ultra-low latency that only localized computer infrastructure can deliver.

-

- Regulatory & Compliance Mandates Data localization rules (RBI, MeitY) are compelling businesses to host sensitive data within national or regional boundaries favoring edge setups.

- Infrastructure Efficiency By processing data locally, edge nodes reduce backhaul traffic, lower latency, and improve energy utilization, particularly in bandwidth-constrained regions.

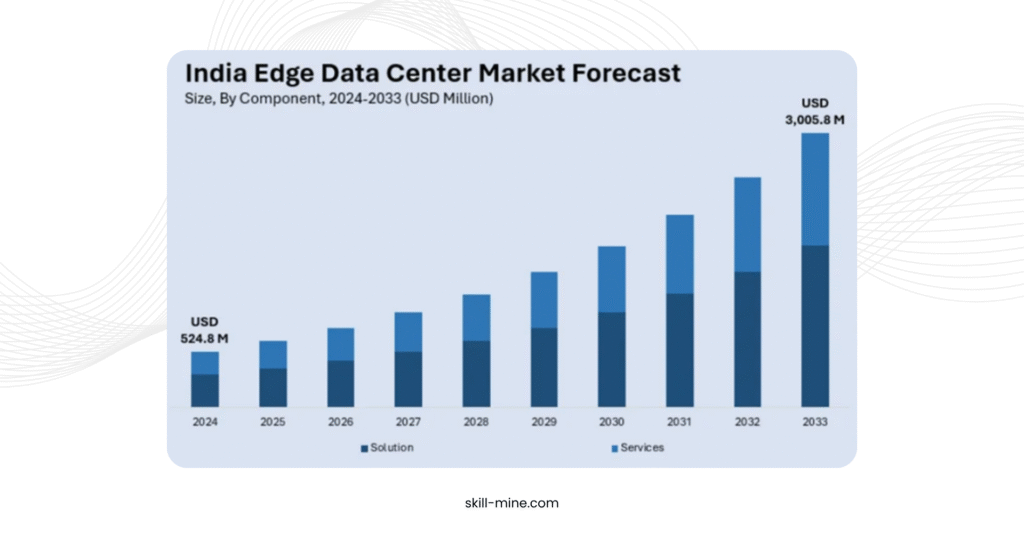

India’s edge data center market, while still emerging, is poised for exponential growth. As per IMARC Group (via w.media), the market was valued at USD 428.5 million in 2024 and is projected to reach USD 3.006 billion by 2033, growing at a CAGR of 19.5%.

According to ICRA, India’s edge data center capacity is expected to triple to 200–210 MW by 2027. This resurgence is not driven by hype but by operational necessity: low-latency responsiveness, geographic proximity to users, data localization compliance, and the need to support emerging technologies. Edge infrastructure is fast becoming foundational to India’s digital ambitions.

This surge is driven by digital transformation across sectors like telecom, BFSI, e-commerce, government, and healthcare, all demanding low-latency processing, edge AI, and localized compliance.

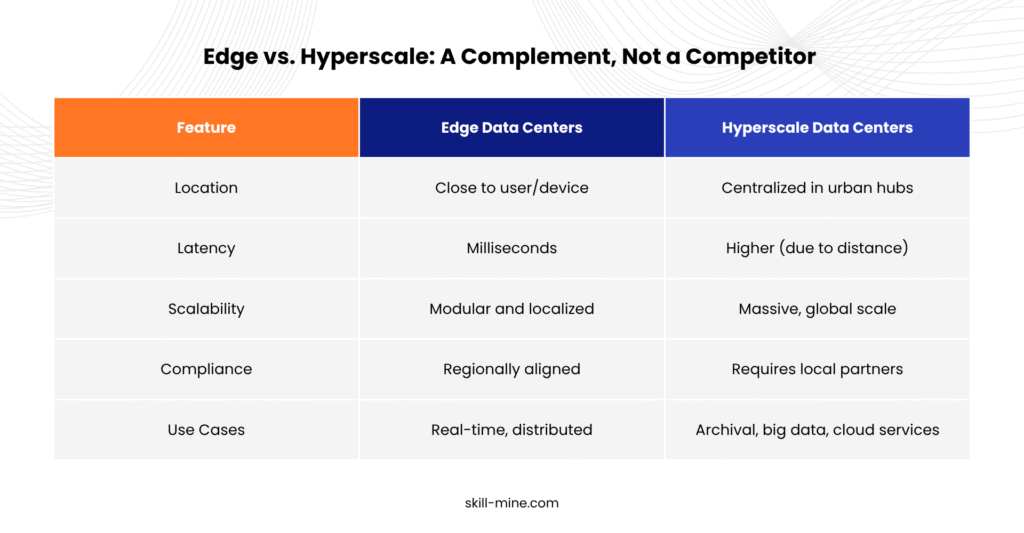

Edge and hyperscale architectures are not rivals, they are complementary. Edge handles immediate workloads; hyperscale provides centralized storage and deep analytics.

- Current Capacity (2024): 60–70 MW

- Projected by 2027: 200–210 MW (3X growth)

- Estimated Investment: ₹5,000–₹6,000 crore over 3 years

- Emerging Edge Locations: Jaipur, Coimbatore, Lucknow, Indore

- Growth Drivers: Government incentives, enterprise digitalization, regional demand

- Closed-loop automation

- Predictive maintenance

- Real-time defect detection

- Smart ICUs and teleconsultations

- Imaging and diagnostics at the edge

- Compliance with NDHM and HIPAA equivalents

- Multi-access edge computing (MEC)

- Local content delivery Network slicing

- Real-time fraud detection

- Localized data processing at ATMs/branches

- Regulatory data residency

- Dynamic pricing engines

- Smart shelves and footfall analysis

- On-site AI inference

- Traffic management

- Environmental monitoring

- Public safety and surveillance

-

- Capital Investment: Building and maintaining distributed nodes can be expensive

-

- Management Complexity: Monitoring hundreds of remote nodes adds operational overhead

-

- Standardization Gaps: Fragmented platforms and inconsistent protocols

- Talent Shortage: Demand for edge-native engineers and architects is outpacing supply

- AI at the Edge: Localized inference powered by devices like NVIDIA Jetson, Google Edge TPU

- Sovereign Cloud Collaboration: Indian cloud firms teaming up with global players to deploy regional edge stacks

- Green Edge: Eco-efficient micro data centers using solar, passive cooling, and edge-optimized power

- Composable Infrastructure: Hardware-agnostic edge setups with orchestration layers for rapid scale

With a projected market leap from $428.5 million in 2024 to over $3 billion by 2033, edge is no longer an option it’s a competitive advantage. As 5G matures, smart cities take shape, and real-time analytics become non-negotiable, the enterprises that embed edge strategies into their core IT frameworks will lead the charge.

Now is the time for CIOs, CTOs, and decision-makers to shift from observation to action because in the edge era, speed isn’t just a metric; it’s a mandate.

-

- ICRA via Economic Times: India’s Edge Capacity Forecast (2027)

-

- DGTLInfra: What Is an Edge Data Center

- IMARC Group via w.media: India Edge Market Forecast