The finance industry is now at our fingertips, thanks to unprecedented accessibility and technological progress. However, this convenience brings a new set of challenges. Whether it’s banks, insurance companies, investment firms, or fintech startups, the entire financial sector confronts substantial cyber threats. As per the 2023 IBM Cost of a Data Breach Report, the financial sector stands as the second highest in global cyber incident damage, trailing only the healthcare industry. Financial organizations experienced losses of around $5.9 million per cyber incident, surpassing the average across all industries, which stands at $4.45 million.

Challenges in Financial Cybersecurity

- Data Security and Privacy:

Fintech firms handle sensitive consumer data, necessitating protection from unauthorized access, breaches, and misuse. Compliance with data protection standards, implementation of strong encryption, and adherence to stringent access controls are imperative.

- Regulatory Compliance:

Operating in a highly regulated environment, fintech companies face demanding cybersecurity requirements. Achieving compliance with standards like GDPR, PCI DSS, and regional data privacy laws can be complex, particularly for businesses operating across diverse jurisdictions.

- Risks from Third-Party Vendors:

Dependence on third-party vendors introduces cybersecurity risks. To uphold client data security and financial system integrity, managing these risks requires thorough due diligence, vendor risk assessments, and effective contract management.

- Human Factor:

Despite robust security measures, the human component remains a significant vulnerability. Insider threats, social engineering attacks, and human error can compromise even the most comprehensive security mechanisms.

Strategies to Ensure Financial Cybersecurity

- Risk Assessment and Management:

Conduct regular risk assessments to identify vulnerabilities, assess threats, and establish effective risk-mitigation measures, including the identification of key assets. Skillmine’s IT Governance, Risk and Compliance (GRC) solution COMPLYment helps businesses in risk management by calculating, reporting, monitoring, remediating and mitigating risks.

- Multi-Factor Authentication (MFA):

Enhance security by implementing MFA, requiring multiple forms of verification for accessing sensitive systems or data, thereby adding an extra layer of protection against unauthorized access. Skillmine’s authentication and authorization solution Auth provides a seamless experience offering SSO and MFA. It also offers an additional layer of security coupled with customer identity secrecy at the highest level, compatible across different platforms supporting multiple protocols.

- Encryption and Data Protection:

Safeguard consumer information by encrypting sensitive data both at rest and in transit. Implement strong encryption methods and rigorous key management procedures to prevent unauthorized access.

- Incident Response and Cyber Threat Intelligence:

Develop a well-defined incident response plan covering detection, containment, eradication, and recovery processes. Utilize cyber threat intelligence services and monitor emerging threats for proactive cybersecurity measures.

- Continuous Monitoring and Testing:

Regularly monitor and test fintech systems for vulnerabilities through assessments, penetration testing, and continuous monitoring of network traffic, systems, and applications.

- Employee Awareness and Training:

Mitigate human-related risks by educating staff through regular training programs, simulated phishing exercises, and fostering a culture of cybersecurity awareness within the organization.

- Cyber Insurance:

Secure an additional layer of financial protection by investing in cyber insurance. This coverage can assist in mitigating the financial impact of a cyber catastrophe or data breach, covering incident response expenses, consumer notifications, legal costs, and potential liabilities.

The Role of AI and Machine Learning in Fintech Security

AI and Machine Learning have become pivotal assets in fortifying cybersecurity measures for fintech firms. These technologies offer multifaceted benefits in bolstering security efforts, including:

Enhanced Threat Detection and Prevention:

AI and ML algorithms excel at analyzing extensive data sets in real-time, enabling early identification of anomalies and potential security breaches. By discerning patterns indicative of malicious activities, fintech firms can proactively thwart cyber threats.

Advanced Behavioral Biometrics:

AI-powered behavioral biometrics authenticate users based on their unique behavioral patterns, providing an additional layer of security beyond conventional methods like passwords and PINs.

Efficient Fraud Detection and Mitigation:

AI and ML capabilities are instrumental in detecting fraudulent activities by identifying abnormal transaction patterns and flagging suspicious behavior. This proactive approach minimizes financial losses and safeguards customers from fraud.

Streamlined Automated Incident Response:

AI and ML technologies automate incident response, enabling fintech firms to swiftly address identified threats by executing predefined actions. This automation reduces response times and mitigates potential damage caused by security incidents.

Continuous Adaptive Security Measures:

AI and ML contribute to the development of continuous adaptive security measures that evolve in real-time based on new data and emerging cyber threats. This dynamic defense strategy ensures proactive protection against evolving threats.

Proactive Predictive Threat Modeling:

AI-driven predictive threat modeling empowers fintech firms to anticipate potential cyber threats based on historical data and emerging patterns. This proactive approach in cybersecurity services aids in devising preemptive strategies to mitigate risks before they materialize, bolstering cybersecurity resilience.

Effective Insider Threat Detection:

AI and ML technologies excel in identifying insider threats by analyzing user behavior and detecting anomalies. This capability is critical for fintech firms to mitigate risks associated with internal actors who may compromise security inadvertently or maliciously.

Integration with Security Information and Event Management (SIEM) Systems:

Fintech firms are integrating AI and ML with SIEM systems to augment security monitoring and response capabilities. This integration facilitates efficient detection of suspicious activities, correlation of cybersecurity events, and timely responses to potential threats.

Adaptive Access Controls:

AI-driven adaptive access controls dynamically adjust user access permissions based on real-time risk assessments. This ensures that users have appropriate access levels, mitigating the risk of unauthorized activities and potential cybersecurity breaches.

The Future of Fintech Cybersecurity

AI and ML will play an increasingly vital role in identifying and responding to cyber threats. Analyzing vast amounts of data, they detect trends and anomalies, enabling more proactive cybersecurity measures. Industry-wide collaboration is crucial to address new cyber risks. Financial services firms, regulators, and cybersecurity professionals must share threat intelligence, best practices, and lessons learned.

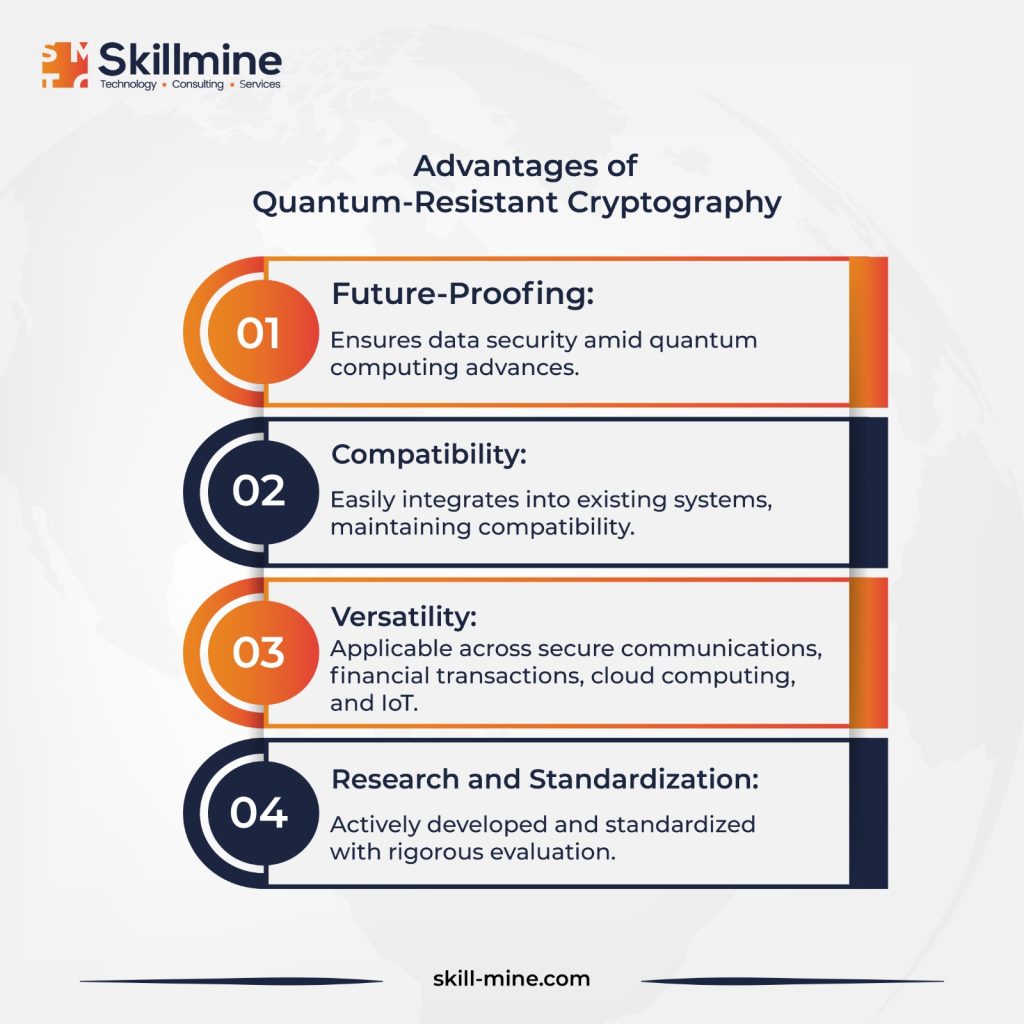

Additionally, the progress of quantum computing poses a threat to current encryption systems. Developing quantum-resistant cryptographic solutions is crucial to ensure data security in the post-quantum era.

With quantum computing advancements, traditional cryptographic methods face unprecedented challenges. Quantum-resistant algorithms offer hope, protecting sensitive information against quantum threats and preserving data privacy and security.

Conclusion

The future of the financial industry hinges on a resilient and secure cybersecurity infrastructure. As cyber threats persist, financial institutions must proactively embrace technology, cultivate a robust cybersecurity culture, and strategically invest to safeguard operations and customer interests. Elevating cybersecurity to a paramount concern enables the financial sector to create a safer digital environment, benefiting all stakeholders. Fintech organizations can navigate future threats, protect client data, and uphold financial system integrity with the help of Skillmine’s cybersecurity services.

Looking for expert technology consulting services? Contact us today.