How BFSI leaders are reducing audit fatigue, improving compliance turnaround, and eliminating human error through intelligent automation.

In the highly regulated BFSI sector, RBI compliance is a critical mandate that demands precision, speed, and constant vigilance. However, traditional manual compliance processes often lead to delays, increased risk, and audit fatigue. To stay ahead, BFSI leaders are turning to intelligent automation to redefine how they manage compliance, reduce operational burden, and strengthen governance.

In the highly regulated BFSI sector, RBI compliance is a critical mandate that demands precision, speed, and constant vigilance. However, traditional manual compliance processes often lead to delays, increased risk, and audit fatigue. To stay ahead, BFSI leaders are turning to intelligent automation to redefine how they manage compliance, reduce operational burden, and strengthen governance.

The Compliance Reality Check

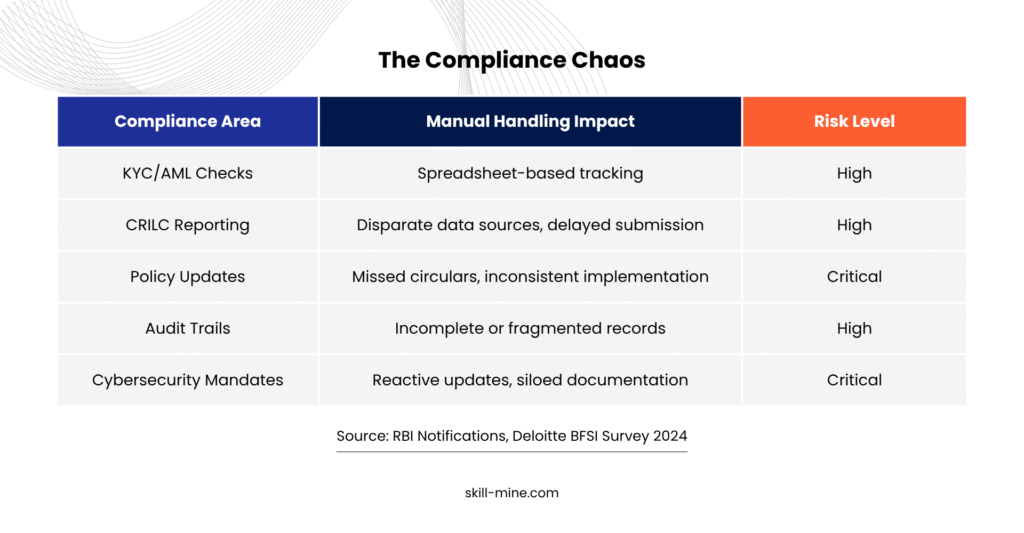

RBI issues over 1,200 circulars and notifications annually, covering everything from KYC and AML to cybersecurity and financial reporting. Managing this sheer volume manually is a herculean task.

The challenges of manual compliance include:

- Complex tracking of frequent regulatory changes

- Time-consuming report preparation

- High potential for human error

- Disjointed audit trails that complicate reviews

Why Manual Compliance is a Problem

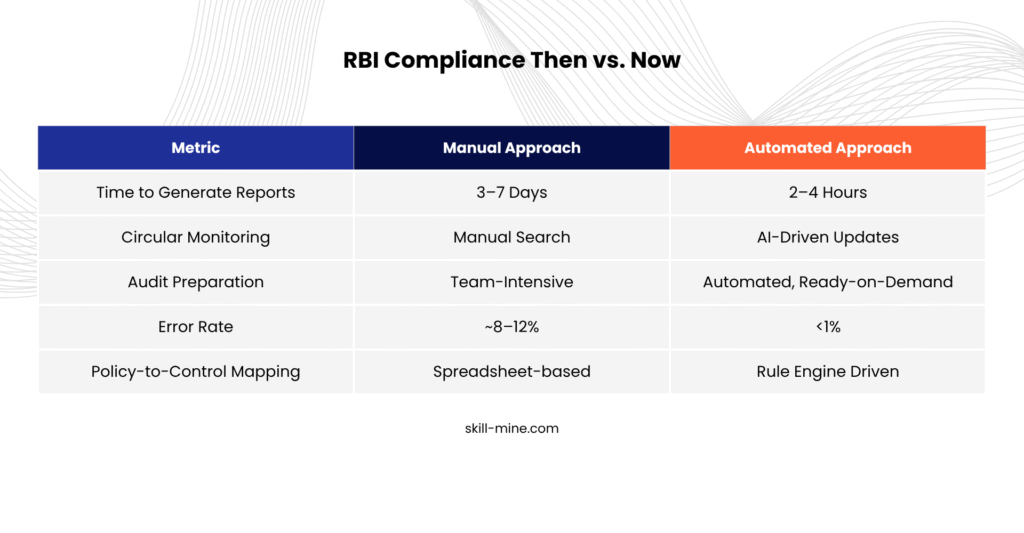

- Turnaround Time: Manual report compilation takes 3–7 days

- Audit Fatigue: Teams are overwhelmed with repetitive tasks

- Error Rates: Manual data entry risks costly mistakes

- Missed Updates: Manual monitoring risks missing critical circulars

Key Capabilities Driving Transformation

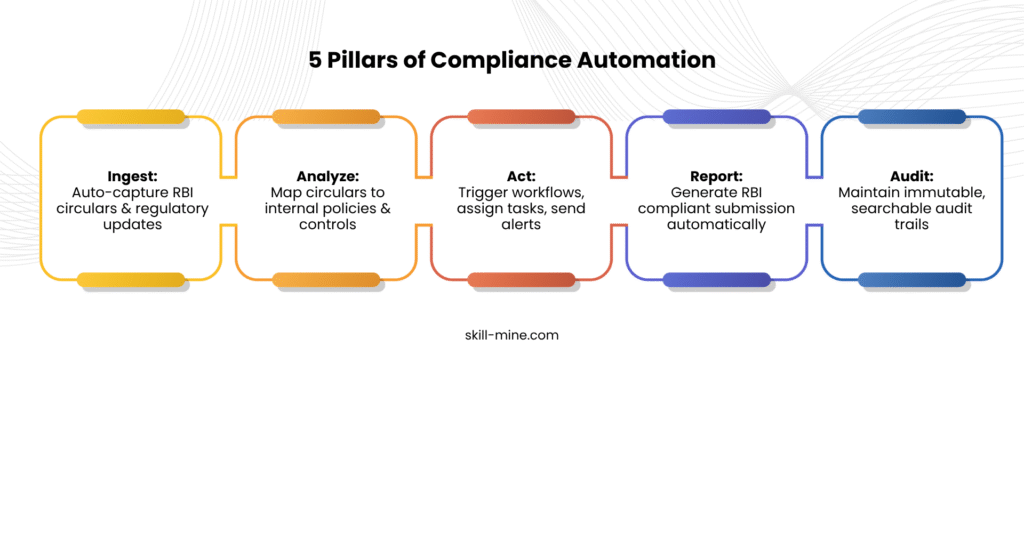

To overcome these challenges, BFSI leaders are adopting intelligent compliance automation equipped with:

- Auto-Parsing of RBI Circulars: Extracts relevant mandates and auto-tags internal policies Impact: Eliminates manual tracking, ensures no circular is missed.

- Automated Workflows: Triggers alerts, validations, and escalations Impact: Achieves 70% faster compliance issue resolution.

- Integrated Compliance Dashboards: Real-time status visibility across teams Impact: Provides decision-ready insights for leadership.

- Immutable Audit Trails: Maintains tamper-proof records of every action Impact: Enables instant, evidence-based audit readiness.

- RBI-Compliant Auto-Reports: Generates RBI-ready reports like CRILC and XBRL Impact: Zero formatting errors, reduces rework.

Case Study: Transforming Compliance at a Mid-Sized NBFC

As we move through 2025 and beyond, these trends are shaping continuous cloud innovation:

- Industry Clouds: Tailored solutions for Healthcare, Financial Services, and Manufacturing.

- Sovereign Cloud Initiatives: Ensuring data residency and regulatory compliance.

- Green Cloud: Sustainability becoming a key KPI (major cloud providers aim for carbon neutrality by 2030).

- Edge Computing Expansion: Processing data closer to the source for latency-sensitive applications (e.g., autonomous vehicles, telemedicine).

The Cloud Journey Never Ends

Challenge: Manual tracking of 400+ RBI controls across multiple business units caused a 5-day compliance turnaround.

Solution: Implemented Skillmine’s Compliance Automation Engine with circular ingestion, automated workflows, and real-time dashboards.

Results:

Solution: Implemented Skillmine’s Compliance Automation Engine with circular ingestion, automated workflows, and real-time dashboards.

Results:

- 80% reduction in report generation time

- 100% audit readiness improvement

- Zero missed RBI notifications for 12 months

The Road Ahead: RBI’s Digital Push & Why Automation is Essential

The RBI is driving a RegTech-friendly environment focused on real-time supervision and automated data submission. Upcoming mandates will emphasize data governance, cybersecurity resilience, and ESG compliance.

Automation is no longer optional, it’s imperative for BFSI institutions to future-proof compliance and governance.

RBI compliance is evolving from a regulatory burden to a strategic advantage, enabled by intelligent automation. Skillmine’s Compliance Automation Framework empowers BFSI leaders to reduce audit fatigue, accelerate turnaround, minimize errors, and strengthen governance.

Compliance is not just about meeting RBI mandates, it’s about leading with confidence in a complex, dynamic regulatory landscape.

Automation is no longer optional, it’s imperative for BFSI institutions to future-proof compliance and governance.

RBI compliance is evolving from a regulatory burden to a strategic advantage, enabled by intelligent automation. Skillmine’s Compliance Automation Framework empowers BFSI leaders to reduce audit fatigue, accelerate turnaround, minimize errors, and strengthen governance.

Compliance is not just about meeting RBI mandates, it’s about leading with confidence in a complex, dynamic regulatory landscape.