From reactive detection to self-directed defense

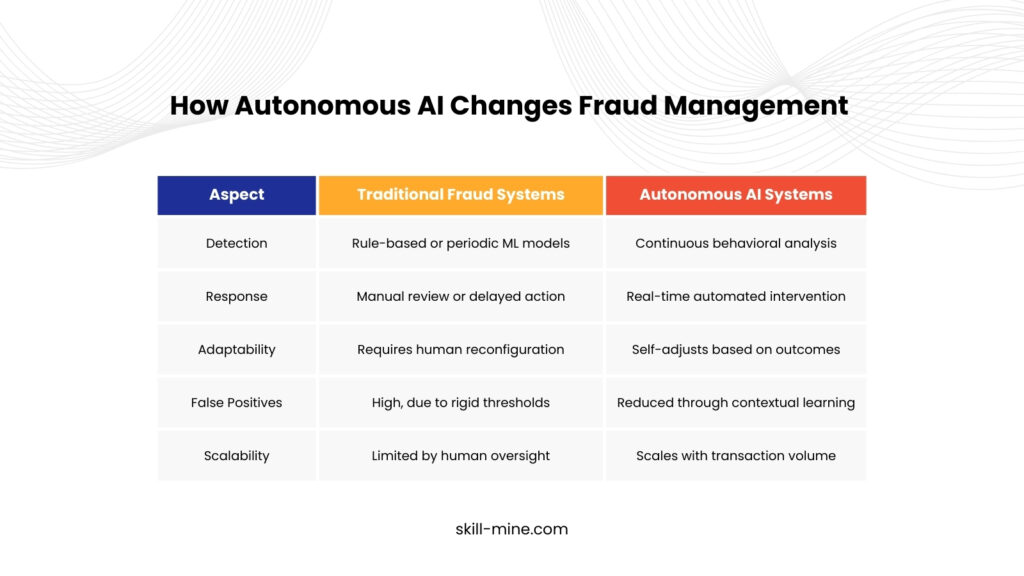

Financial fraud is no longer a slow or predictable threat. It evolves in real time—adapting to controls, exploiting gaps between systems, and moving faster than traditional rule-based defenses. As digital transactions scale and fraud tactics become more sophisticated, financial institutions are turning to Autonomous AI to move from reactive monitoring to proactive, self-adjusting protection.

What is Autonomous AI in Finance?

Autonomous AI refers to systems that don’t just analyze data or flag anomalies but can make decisions, take actions, and continuously learn with minimal human intervention. In finance, this means AI models that can detect suspicious behavior, initiate responses, adapt thresholds, and refine strategies based on outcomes all in near real time.

Unlike traditional AI models that require frequent manual tuning, autonomous systems operate as closed-loop systems: observe → decide → act → learn.

Unlike traditional AI models that require frequent manual tuning, autonomous systems operate as closed-loop systems: observe → decide → act → learn.

Why Traditional Fraud Detection Falls Short

Most legacy fraud systems rely on static rules, historical patterns, or periodic model updates. While effective against known fraud types, they struggle with:

- Novel attack patterns

- Coordinated fraud across channels

- Rapid shifts in user behavior

- High false positives that impact customer experience

Key Use Cases in Finance

Autonomous AI is already reshaping multiple fraud-related functions:

- Real-time Transaction Monitoring: Detects anomalous behavior across devices, locations, and transaction flows.

- Account Takeover Prevention: Identifies subtle deviations in login behavior and access patterns.

- Payment Fraud Mitigation: Dynamically adjusts risk scoring based on evolving fraud tactics.

- AML Support: Prioritizes high-risk cases and reduces alert fatigue for compliance teams.

The Balance Between Autonomy and Control

Despite its advantages, autonomous AI in finance must operate within strict governance boundaries. Explainability, auditability, and regulatory compliance remain critical. The most effective implementations combine:

- Guardrails for decision-making

- Human override mechanisms

- Transparent model reasoning

- Continuous validation and monitoring

Looking Ahead

As fraud becomes more adaptive, defenses must do the same. Autonomous AI represents a shift from static protection to living systems that evolve alongside threats. For financial institutions, this isn’t just a technology upgrade—it’s a strategic necessity.

The future of fraud prevention isn’t faster rules. It’s smarter, self-directed intelligence.

The future of fraud prevention isn’t faster rules. It’s smarter, self-directed intelligence.