The banking industry has frequently resisted change and maintained the archaic core banking. By definition, core banking includes all of the fundamental financial services, including payments, loans, mortgages, and accounts, as well as the supporting back-end technology.

Due to the direct impact these core components have on the efficiency and dependability of every process, the organization would struggle to satisfy even the most basic client requests if they become outdated.

Legacy core banking platforms develop a life of their own after years of being serviced and updated by many IT service providers, and are now frequently expensive to purchase and maintain. Fintech, on the other hand, was created to be flexible and sensitive to market developments, effectively upgrading its basic technologies as needed.

What are legacy systems?

A legacy system in information technology is an older computer system or application program that keeps running long after newer systems are deployed. Depending on whether they replace an existing system or update an older system, newer systems are sometimes referred to as greenfield or brownfield systems.

DID YOU KNOW?

The word “legacy” is derived from “legacy code,” a phrase for obsolete programs that are still in use. Typically, legacy code is 10 years old or older. The term is used to refer to internal accounting software.

Most popular banking apps available today, whether mobile or web-based, are still supported by legacy systems in the banking industry.

Due to the rising demand for new features and better user experiences, many of these systems are no longer viable, making it challenging for financial institutions to provide customers with convenience and efficiency. Hence, it is critical to modernize legacy systems in banking.

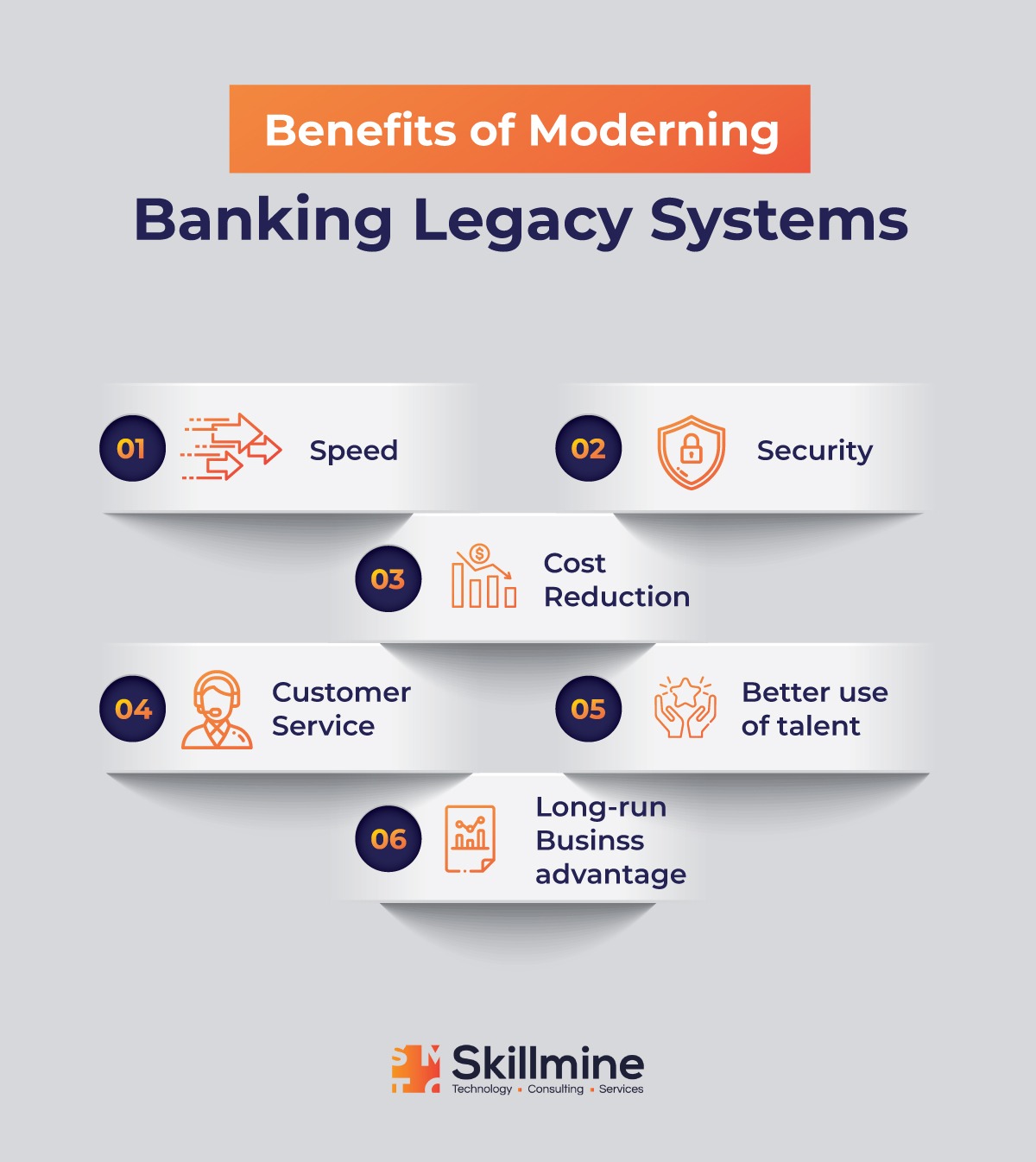

Benefits of modernizing banking legacy systems

Tips for legacy software modernization

Create a flexible data platform: Avoid trying to integrate everything into one new data platform. Instead, work on establishing user-friendly interfaces for these processes. Start with those invaluable sources that offer in-depth information into client behaviour or performance, such as credit card transactions or mobile phone records.

Implement microservices: Decentralization and the creation of new applications with a focus on how customers today want to engage with their banks should be the main areas of development. Microservices work well for this objective.

Categorize capabilities for customer journeys: Banks should list their unique needs for seamless digital experiences and pinpoint their most important customer procedures. The first step is determining which tasks are necessary and which are not at each stage of a journey. It could be alluring to utilise new technology as a chance to offer every service imaginable, but banking officials should be conscious that if they don’t keep things simple at all times, they risk creating complexity.

Prioritize integration: Leading banks employ a strategy of integrating contemporary tools while maintaining old core, as opposed to simplification of systems. Over time, they begin gradually shifting essential processes to their new environment.

Rely on SaaS for non-critical capabilities: SaaS has proven particularly successful for optimizing business operations, even though many organizations still rely on internal resources for service delivery. IT teams may concentrate their efforts on updating their mission-critical software by shifting applications like HR, procurement, and other back-office systems (such as accounting) from onsite servers to a cloud platform.

Conclusion

Using these five principles, banks may not only drastically cut costs and turnaround times but also guarantee superior results in terms of quality and dependability. The key to ensuring the architecture’s resilience and future-readiness is to enable a better interface layer. However, banks will also need to restructure their operational model to focus more on productivity to benefit the most from this new modernization method.

Modernization of legacy banking systems requires commitment to change management and the continual evolution of the IT architecture across the entire business. Banks that are able to alter both the operating model and the technology will be well on their way to obtaining a more cost-effective modern IT architecture.

Looking for expert technology consulting services? Contact us today.